interest tax shield fcff

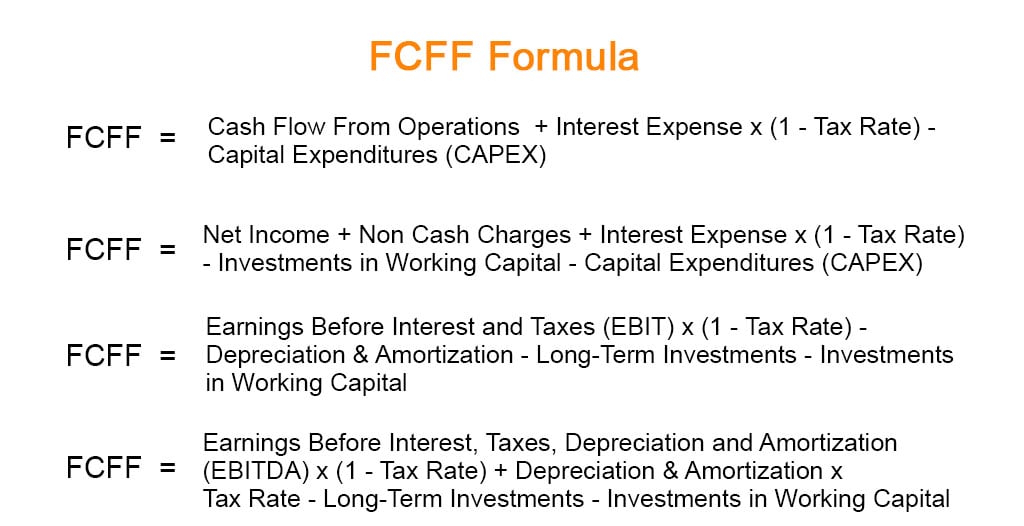

The interest on debt lowered the taxable income thus the interest must be multiplied by 1. 1 Interest expense is not included because it is paid to bond holders.

Financecore Tax Shields Explained Youtube

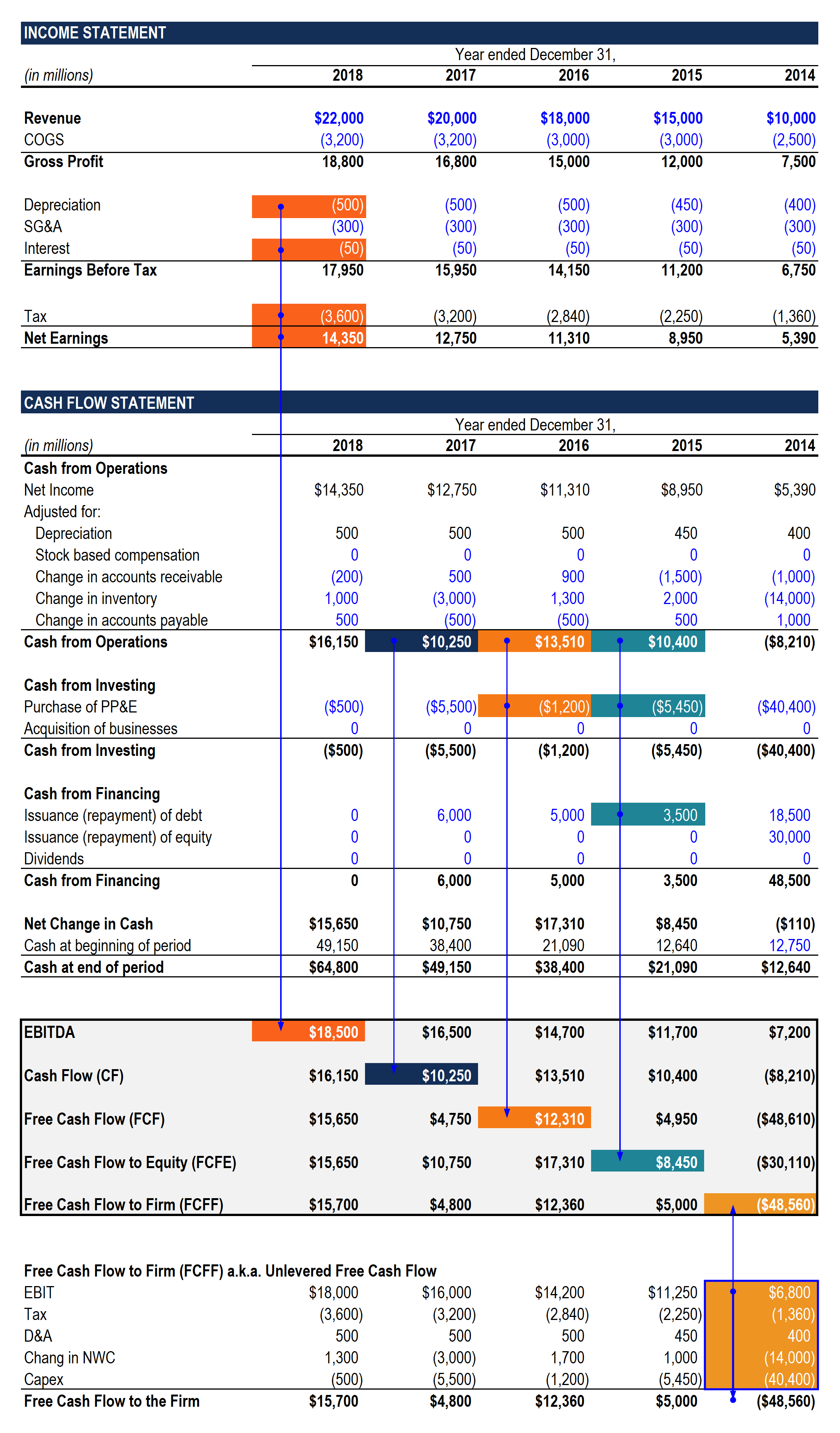

Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for.

. Accordingly EBIT1-T also known as Net Operating Profit after Tax NOPAT is a measure of. 2 EBIT is multiplied by 1-Tax rate to account for the interest tax. Answer 1 of 6.

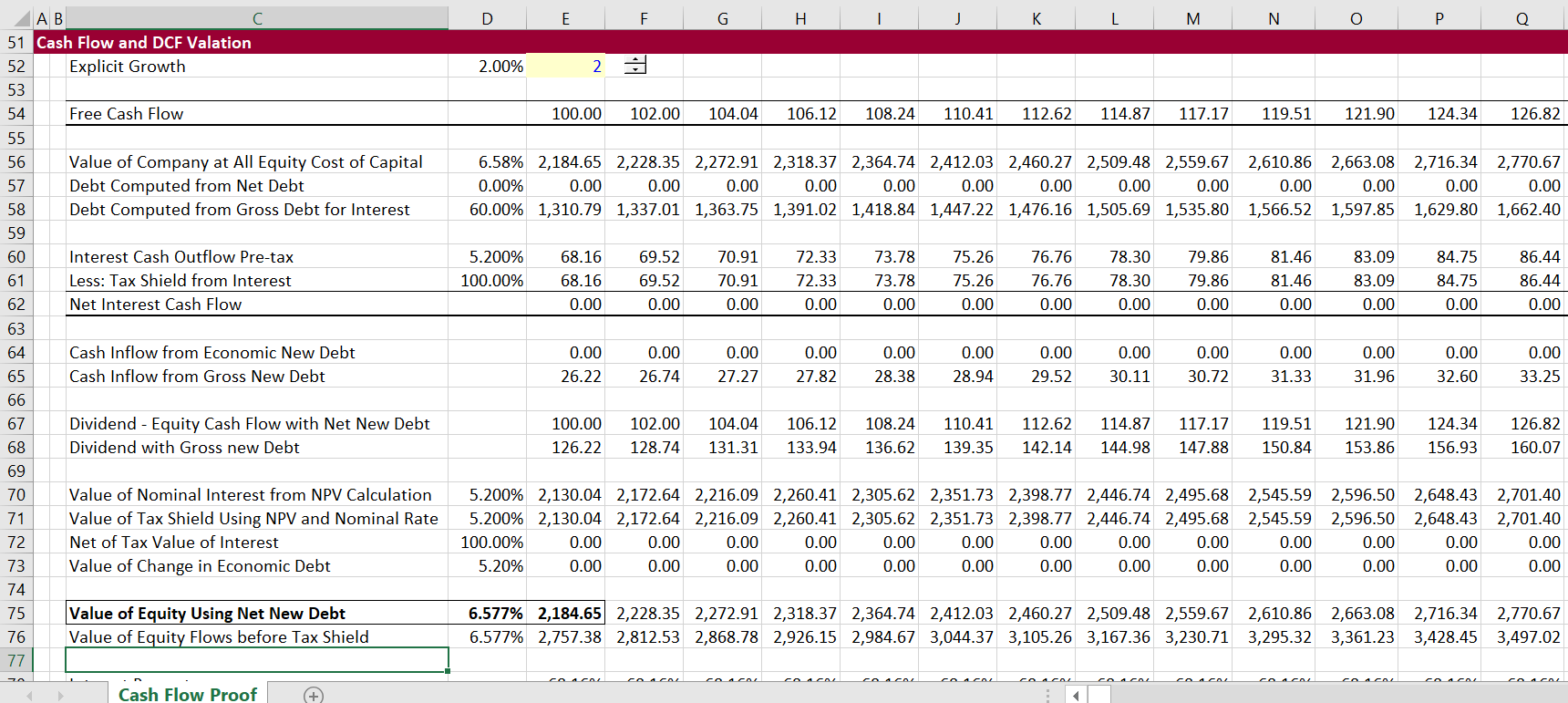

Free Cash Flow For The Firm - FCFF. Without the tax shield Company Bs interest. Thats because you use tax adjusted WACC for discounting FCF.

Answer 1 of 5. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. If you dont want to add tax.

Since this captures the tax deductibility of interest the same. Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million. The way that is usually taught is that the contribution to the WACC of the cost of debt is reduced by the tax rate.

Interest Tax Shield Interest Expense Deduction x. In addition the tax shield associated with interest must be added back too ie the tax savings. Unlevered FCF cash the business has before paying its financial obligations.

FCFF is cash available to Equity AND bond holders. FCFF Earnings Before Interest Tax Depreciation And Amortization EBITDA 1 Tax Rate Depreciation. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

FCFF includes an interest tax shield as opposed to FCFE. Wacc weighted average cost of equity and tax adjusted cost of debt. They recognize the underlying expenses while calculating net cash Net Cash Net Cash represent the companys liquidity position and is.

And an interest expense of 10 million.

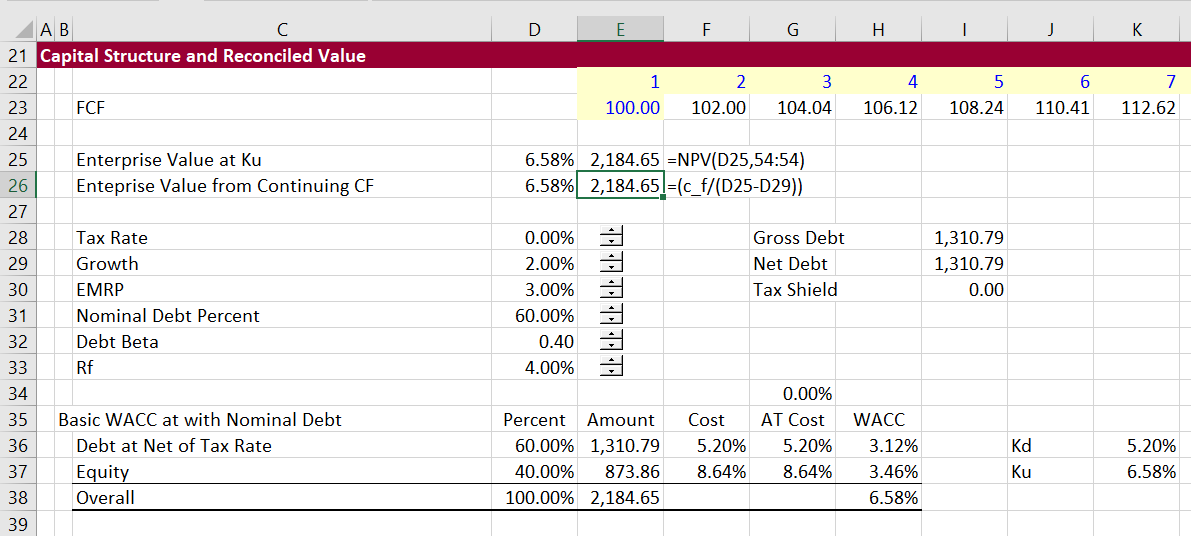

Proof Of Valuation Using Ku Or Wacc Without Interest Tax Shield Edward Bodmer Project And Corporate Finance

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Berk Chapter 15 Debt And Taxes

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Tax Shield Formula Step By Step Calculation With Examples

What Is Free Cash Flow Fcf How To Calculate Free Cash Flow

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Valuation Part 2 Fcff Fcfe Varsity By Zerodha

Free Cash Flow To Firm Fcff Formulas Definition Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Fcff Formula Examples Of Fcff With Excel Template

2023 Cfa Level Ii Exam Cfa Exam Practice Question

Free Cash Flow Yield Formula And Calculator

/Term-Definitions_freecashflow_FINAL-ebecf2a8576047c0a8b9446f29b63b71.png)